By Fitness business Insider

Recession rumors are rampant and protecting yourself from economic downturns will likely continue to dominate business conversations until we see some market stability. To maintain your business’s financial health through the current turbulence, follow these five steps:

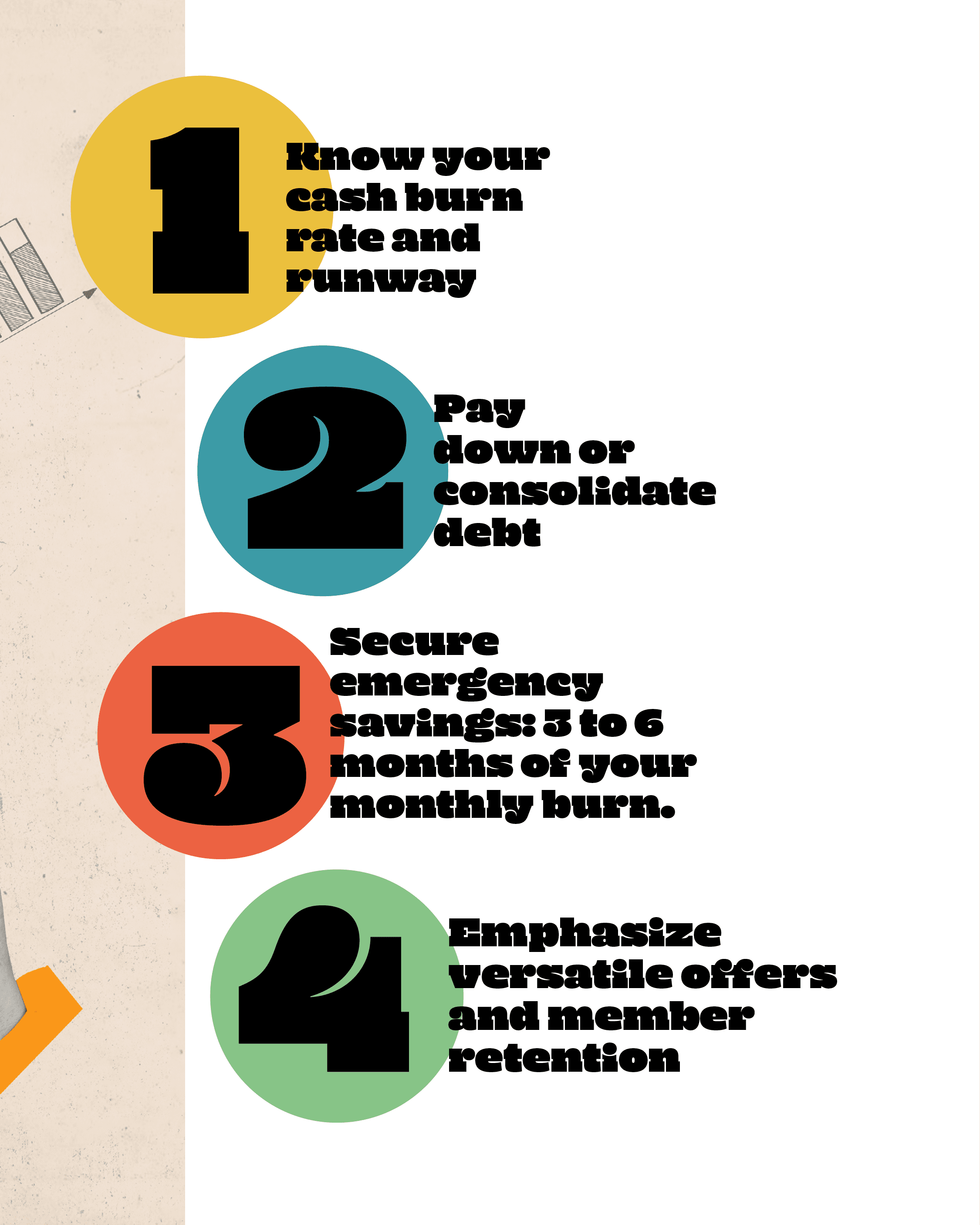

#1 Know your cash burn rate and runway.

Get clear on your burn rate (–the amount of money your business spends each month) to help you determine how many months your current cash levels will support your business (–your runway). The more you can cut, the more you can reinvest in your business or save. To ensure you’re spending money in ways that are necessary and purposeful, perform an audit using our 5 Question Test to Trash Unwanted Expenses. We use this exact strategy with our clients to save $5k-$20k/year. Reviewing your monthly P&L against your Profit Plan will keep you on top of changes so you can quickly shift or continue doing more of what is working.

#2 Pay down or consolidate debt.

Interest rates are on the rise as the Fed tries to combat inflation. The higher the rates, the more interest you pay with variable debt like credit cards. Consolidating your credit card debt into a balance transfer 0% interest credit card will ensure your payments are going toward the principal balance rather than interest. Most cards have a small transfer fee with 12-to-21-month terms to pay off the balance before interest starts accruing. When assessing your debt pay down strategy, consider factors like interest rates, minimum balance payment, number of periods remaining, and emergency savings balance. Working with a financial professional is the best way to establish an overall financial plan to maximize cash flow to efficiently pay down your debt.

#3 Secure emergency savings: 3 to 6 months of your monthly burn.

During the pandemic, businesses that didn’t have emergency savings or couldn’t effectively manage cash flow did not survive. If you don’t have 3 to 6 months of your monthly burn on hand, here are two strategies to generate extra cash:

1. Offer annual Paid in Full Memberships. You generate more cash up front and your members get 12 months for the price of 11 for paying in advance. It’s a win/win! (Pro Tip: allow only a limited number of these memberships; you’ll get an influx of cash but lose some recurring monthly revenue, so determine what your profit plan can sustain.)

2. Feature a high-ticket offer focusing on a specific outcome or transformation. With a high-ticket offer, you develop a full-service program that goes beyond the standard membership or class pack to solve underlying problems experienced by a niche group of members. This offer isn’t for everyone, so aim for 10% of your member base. Our 5 Step Guide will ensure you’re successful!

#4 Emphasize versatile offers and member retention.

Businesses that are thriving post-pandemic create offers to meet customers where they want to work out (in-person and/or virtual) at prices that appeal to various financial budgets. A popular membership strategy is the 4x, 8x, 12, and All Access, which inspires consistency and commitment. (The recurring membership revenue yields consistent cash flow to achieve tips 1-3 above!) It’s less expensive to retain a client than to acquire a new one, so satisfying and maintaining your membership is key. To do this, build a community your members can’t live without with these five essential retention strategies:

1. Barry Kostabi from Fitness Career Mastery believes in “getting clear on the story your brand is telling. Members want to feel like they belong, and when they do, they’ll choose your community over any other. This requires that the story your brand tells clearly communicates your core values to attract the people who share them. When people with common beliefs come together, they become mutually accountable, and it all starts with understanding who you’re meant to serve.”

2. Marketing consultant Alexa Cawley says: “developing an early-stage milestone program for your new clients is essential to conversion. Create a pricing strategy and marketing plan to target your client’s first six visits within their first 30 days.”

3. Jaimie Austin of Active Core maintains that “the first 3-4 months are pivotal to creating long lasting relationships. Your new member is establishing their routine and folding you into their lifestyle. Create an omni-channel communication plan using email, text, and personal phone calls to keep their experience curated and their engagement high.”

4. Jaimie also recommends “building community outside of your studio. Make local connections where members spend their time, and host events to showcase what makes you truly special. By customizing the experience to your ideal members, you’ll deepen existing connections and grow the community. Lastly, find strategic community partners to “champion” your partnership and event.”

5. Shay Kostabi recommends “investing in instructor development. Fitness consumers are willing to pay more for an experience and investing in your instructors’ development ensures the highest quality and most consistent experience possible. Trust in your brand will grow while your instructors feel valued, challenged, and motivated to give their best.”

#5 Don’t panic!

Recessions are a normal part of the economy’s fluctuations, and this current downtick won’t rival the pandemic’s impact. If you have a strong cash flow plan with offers that speak to your members, pricing to ensure profitability, effective lead generation and retention processes, the recession will not feel so heavy on your business.

Lauren Schoenfeld launched her career at PricewaterhouseCoopers and went on to pivotal positions at WeWork and Equinox, where she gained the knowledge and expertise on leading entrepreneurs and businesses to exceptional growth locally and internationally.